|

cheap health insurance for pets that actually covers what mattersYou want predictable costs and fast reimbursements, not fine-print surprises. The trick is separating "cheap" from "thin." You're optimizing total cost of ownership, not hunting the lowest premium at any price. Define "cheap" in terms of outcomes, not sticker pricePremium is only one lever. Deductible, coinsurance, annual caps, and exclusions decide how much you'll really pay. Anchor on your pet's risk profile and the care you want funded - then price backwards. - Premium: recurring cost; lower isn't automatically better if claims get denied or capped.

- Deductible: yearly vs per-incident; yearly is simpler if you expect multiple visits.

- Coinsurance: 70 - 90% back after deductible; 80% is often the efficiency sweet spot.

- Annual cap: targets severity risk; $5k - $10k often balances price and protection.

- Per-condition cap: risky for chronic issues (allergies, arthritis, IBD) that stack over time.

Comparison, made efficient- Profile your pet: age, breed risks (brachycephalic, large-breed ortho), lifestyle (urban stairs, off-leash hikes), prior notes.

- Quantify realistic spend: routine care vs emergencies; include aging curve after year 6 - 7 for dogs, 9 - 10 for cats.

- Model 3 designs: low premium/high deductible, balanced 80%/mid deductible, and premium-rich/low deductible. Compare 3-year totals.

- Stress-test: run one big emergency, one chronic condition, and a no-claim year. Pick the winner across scenarios, not just the average.

Coverage tiers to scrutinize- Accident-only: cheapest, but illness (cancer, pancreatitis) isn't covered.

- Accident + illness: the core you likely need; check hereditary and chronic coverage.

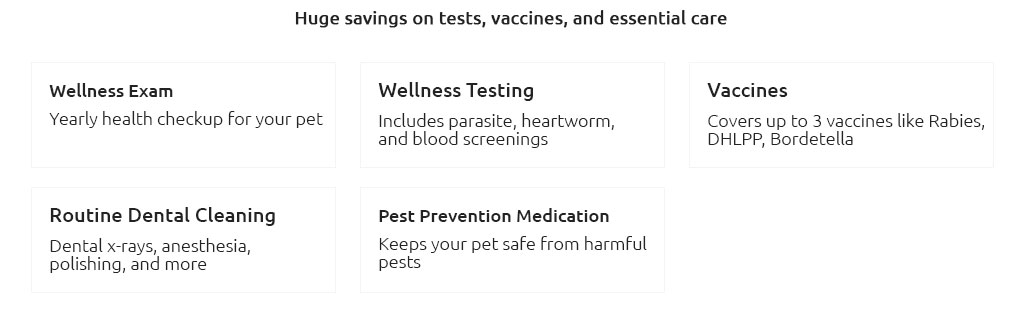

- Wellness add-ons: useful if priced below retail vaccines/tests; otherwise self-fund.

- Chronic/long-tail: lifetime coverage for recurring conditions is pivotal for real savings.

- Hereditary/congenital: confirm inclusion and any age/breed limitations.

Realistic check: pre-existing means "documented in records," not "diagnosed." If a limp or allergy is mentioned once, future claims can be excluded. If you're considering coverage, apply before that first "let's keep an eye on it" note lands in the chart. Cost levers that trim price without hollowing coverage- Choose a deductible you'll reliably meet in a bad year; $250 - $500 often optimizes price-to-utility.

- Set coinsurance to 80% for steady savings; 90% gets expensive quickly unless you expect heavy claims.

- Pick an annual cap that fits local ER pricing; many emergencies clock $1,200 - $3,500, surgeries $4,000 - $8,000.

- Use multi-pet discounts only if individual terms stay strong; don't trade coverage for 5% off.

- Pay annually if the fee-free discount beats your cash yield; otherwise monthly is fine.

- Tele-vet triage can prevent costly ER visits; verify it's included and reimbursable.

Claims efficiency: speed and probability of paymentAsk for itemized invoices with procedure codes and doctor notes; submit same day via app; keep direct deposit on. Faster adjudication lowers the real cost of care by reducing cash float and resubmission friction. Exclusions you must model explicitly- Waiting periods: accidents (48 hrs - 14 days), illness (7 - 30 days), ortho/ACL (up to 6 months) unless waived by exam.

- Bilateral clauses: one kneecap means the other could be excluded - read this twice for ortho breeds.

- Dental: trauma often covered; periodontal disease often not, unless you add a dental rider.

- Breed-specific restrictions: discs, hips, BOAS; confirm no hidden sub-limits.

- Alternative therapies: rehab, acupuncture, and supplements can be game changers for mobility - ensure they're in-scope.

A quiet real-world momentSunday, 7:12 p.m. Your cat slices a paw on a broken mug; ER visit runs $1,150 including sedation and stitches. You pay the clinic, file in three minutes from the parking lot, and 80% hits your account by Friday. Not glamorous - just the friction you avoided. Decision math you can do in five minutes- Expected cash outlay (year) ≈ premium + deductible (if likely met) + coinsurance share on typical care.

- Downside hedge: one $6,000 surgery at 80% back turns a high-premium plan into a bargain; a low-cap plan may still cost you thousands.

- Three-year lens: premiums rise with age; bake in 8 - 15% yearly increases to avoid surprises.

Signals during comparison- Green: clear policy language, lifetime chronic coverage, fast reimbursements, transparent age-based pricing, pre-authorization support.

- Red: per-condition caps for chronic care, shrinking annual limits, many "not medically necessary" denials, vague bilateral wording, mandatory networks without clear opt-outs.

Practical next steps- Pull last two years of vet records and note any flagged issues.

- Request sample policies and exclusion lists for three insurers; read ortho, hereditary, and dental sections fully.

- Run the three-scenario test (no-claim, one emergency, one chronic) with your local price assumptions.

- Pick the design that wins on both average spend and worst-case protection; then lock it in before the next wellness exam adds new notes.

Cheap can be smart - if you engineer it. Compare structure first, price second, and keep your paperwork tight. That's how you turn coverage into real savings, not just a low number on a website.

|

|